It is an unpleasant truth which people often tend to overlook: The master data is often not as good as one would like it to be. Specifically for CRS and FATCA reporting, very high data quality is required to generate correct and complete reports to the tax authorities. In practice, the data gaps that often remain can be time-consuming and expensive to correct. With our software solution i:Reg, these gaps are detected in time and can be eliminated by the financial institutions.

We are talking about data quality or, more accurately, insufficient data quality and how it can be permanently improved. Specifically for CRS and FATCA reporting, very high data quality is required to generate correct and complete reports to the tax authorities.

Today, financial institutions have clear and comprehensive requirements about which customer information must be recorded. Some requirements are legal, others come from internal processes. Fewer provisions and forms existed in the past and that poses challenges today regarding the completeness of the master data. Data gaps that arose this way are usually not corrected until the next customer meeting, some time in the future. For example, in 2015 CRS contained no requirements TIN verification or a validation checks.

Data gaps must be eliminated in the core system

It may be irrelevant to the core system of a financial institution whether a particular attribute is recorded for a customer. But it may still become a stumbling block when some later processing requires this information. Since the different downstream systems require different information, the list of attributes that are mandatory in the core system becomes very long, even when they are not absolutely necessary in the core system itself. So everything begins in the core system – either there is no field for certain information where the customer data is originally entered, or it was not mandatory to fill in these fields in the past.

Issue: mandatory fields

In fact, mandatory fields are a double-edged sword because, on the one hand, the customer should be completely recorded, but, on the other hand, the customer creation has to be fast and should not be blocked by details that can also be recorded later – provided, of course, that these subsequent additions are actually made. And provided that there is an adequate field for this purpose.

Whatever the cause, in the end there are often gaps in the data that can be time-consuming and expensive to correct.

Our software solution i:Reg detects data gaps in time

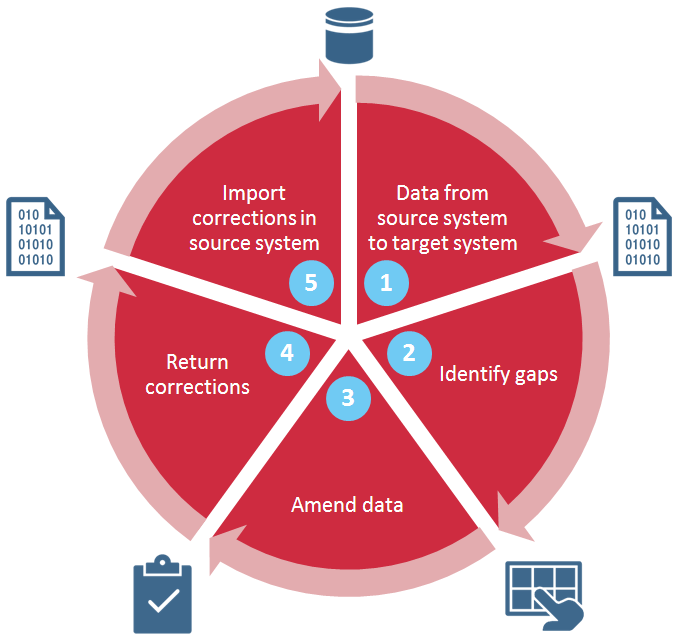

Due to the legal reporting obligations to international tax authorities, data gaps are especially unpleasant if they can prevent correct reporting. In order to create these complex reports it is now necessary to use a software product such as i:Reg. Because i:Reg detects and displays the gaps automatically, financial institutions become able to correct them systematically.

The gaps can be filled directly in i:Reg (so that at least the reports are correct), or this valuable information could be sent back to the data source – thus permanently improving the data quality for the benefit of other systems.

Conclusion

It pays off to correct the data quality directly at the source in order to avoid recurring problems while saving costs at the same time. In the words of John Wooden, “If you don’t have time to do it right, when will you have time to do it over?”